What is a Real Estate Due Diligence Checklist?

A real estate due diligence checklist is a comprehensive list of items and tasks that must be reviewed and investigated before purchasing or investing in a real estate property. It serves as a systematic guide for investors, businesses, and other individuals to examine relevant aspects of the property toward informed decisions on purchase or investment potential.

Why is a Due Diligence Checklist Important in Real Estate Transactions?

Using a due diligence checklist as a key tool in real estate transactions can be beneficial in various ways, including the following:

- Mitigating Risks – helps identify potential property risks and issues, allowing buyers or investors to make informed decisions and take appropriate measures to address risks

- Uncovering Hidden Problems – helps identify structural, environmental, or legal issues, which might not be immediately apparent during a casual inspection

- Negotiating Power – allows buyers to negotiate better terms based on the property’s actual condition and potential risks

- Meeting Legal and Regulatory Requirements – helps prevent future legal troubles that could arise from purchasing a property with unresolved issues

- Assessing Investment Potential – provides a clear understanding of the property’s financial viability and calculates expected returns accurately

- Understanding Market Conditions – helps buyers determine the property’s fair market value

- Promoting Fact-based Negotiations – encourages a more objective negotiation with help from the data and evidence gathered from due diligence

- Building Trust – fosters transparency and trust in the transaction process

- Fulfilling Lender Requirements – helps secure financing for the purchase by providing due diligence reports to lenders

Also, checklists for real estate due diligence can be helpful in various types of real estate, including the following:

- Residential Properties

- Commercial Properties

- Industrial Properties

- Vacant Land

What Should Be Included in a Real Estate Due Diligence Checklist?

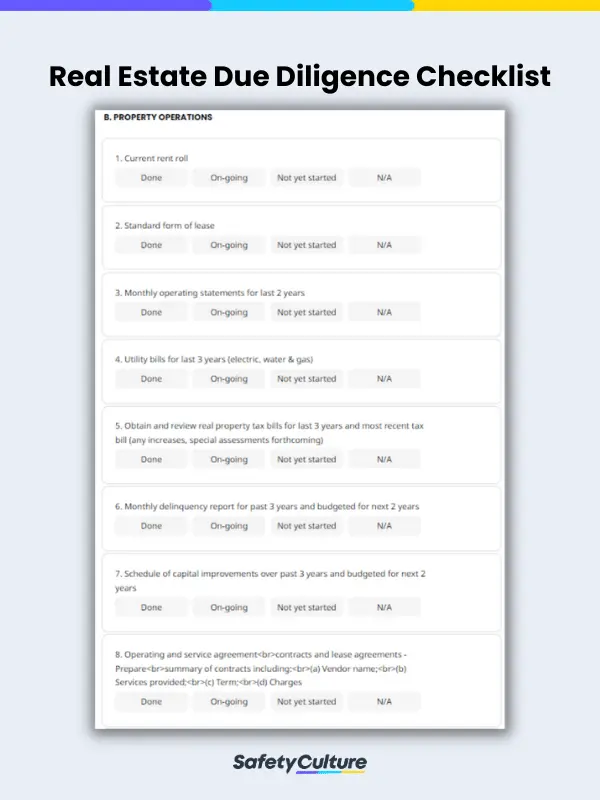

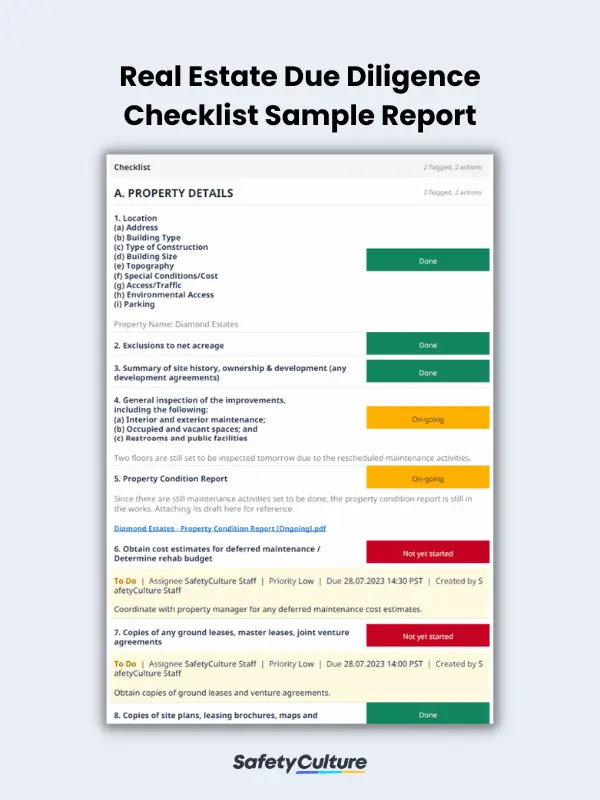

For you to thoroughly assess a real estate property and its potential risks, you must include key categories and items in your checklist. To guide you, here are some general sections that must be present in it:

- Property Details

- Property Operations

- Tenant Information

- Contract/Legal Information

- Title/Survey

- Environmental Site Assessment

- Litigation

- Zoning and Entitlement Status

- Local Advice

- Governmental Considerations

- Utilities

- Completion and Sign-off

It’s also important to note that while these are the common items to include in your checklist, you can always customize it based on the specific type of real estate transaction you may have. Also, take into account the individual requirements of buyers or investors to help you make your real estate due diligence checklist more unique and efficient.

How to Create an Effective Real Estate Due Diligence Checklist

Creating an effective real estate due diligence checklist requires careful planning and attention to detail. Since there are in-depth tasks and items needing to be assessed during due diligence, this must be considered during the creation of the checklist.

To help you get started, here’s a step-by-step guide on how to prepare one for your real estate transactions:

- Identify the type of real estate and the size and complexity of the transaction. Are you buying a property for personal use, investment, or development?

- Familiarize yourself with local real estate laws, zoning regulations, and environmental requirements that might impact the property. Ensure compliance with legal obligations during the due diligence process.

- Engage a team of experts, including real estate agents, lawyers, surveyors, and environmental consultants, to assist in the process and collect their valuable insights into different aspects of the checklist.

- Create a checklist template that includes all the essential categories and items relevant to your specific real estate transaction. Make sure to divide the checklist into sections for easier organization and tracking.

- Include a completion or sign-off page where users can note any additional information and include their signatures.

Guide on Using a Checklist in Real Estate Due Diligence

Using a checklist in real estate due diligence is a systematic way to organize and conduct a thorough investigation of a property before making a purchase or investment. Follow this guide to effectively use a checklist in your real estate due diligence process:

To systematically organize and conduct a thorough investigation of a property before deciding to buy or invest in it, having a trusty real estate due diligence checklist is a must. Here’s how you can take advantage of its logical features and uses:

- Collect all available documentation related to the property, such as title deeds, surveys, tax records, leases, and any relevant permits or approvals.

- Conduct a thorough assessment of the property’s condition, structural integrity, and potential environmental risks. Note any needed repairs.

- Review financial statements to evaluate the property’s financial performance.

- Check for any legal disputes or pending litigation related to the property.

- Evaluate insurance coverage and identify potential risks, such as natural disasters or liability concerns.

- Examine lease agreements, tenant payment history, and occupancy rates to understand the property’s rental income stability.

- If applicable, assess existing property management or explore property management options and costs.

- Summarize the key findings and recommendations in a formal report. Include any potential risks and opportunities for the property.

- If any issues are identified, plan for necessary follow-up actions. These may include additional inspections, negotiations, or obtaining professional advice.

- Use the information from the due diligence checklist report to make informed decisions about the property and negotiate with the seller based on the results.

FAQs About Real Estate Due Diligence Checklists

While the primary purpose of the checklist is to safeguard buyers or investors by thoroughly evaluating the property, it also benefits sellers in several ways:

- Promoting Transparency

- Reducing Liability

- Ensuring Fair Price Negotiations

- Speeding Up Transactions

- Providing Proof of Compliance

- Enhancing Marketability

- Ensuring Risk Mitigation

- Facilitating Financing

- Securing Favorable Terms

A due diligence checklist should be used at the early stages of a real estate transaction and throughout the entire buying or investment journey. Specifically, here are some cases when it should be used:

- Initial Property Search

- Pre-Offer Stage

- During Negotiations

- Offer Acceptance

- Contingency Period

- Before Closing

- For Investment Properties

- For Development Projects

- For Commercial Transactions

No, a due diligence checklist can’t ensure a successful real estate transaction on its own. Several factors contribute to the success of a real estate transaction, and while due diligence is a critical part of the process, it’s just one aspect. Its primary purpose is to inform and guide decision-making, not to guarantee a positive outcome.