What is Fraud Risk Assessment?

Fraud Risk Assessment is a step-by-step process usually carried out by risk managers to proactively identify and minimize business vulnerability to fraud. Fraud risk assessments help prevent fraud that can take place in the form of corruption, asset misappropriation, and theft of intellectual property, among others.

Why is Fraud Risk Assessment Important?

The Association of Certified Fraud Examiners reported that small businesses lose twice as much due to fraud compared to big businesses. This is mainly because small businesses have a more trusting environment and less internal controls to mitigate fraud risk. Conducting fraud risk assessments is important because it can help:

- Improve communication within teams;

- Identify which business processes are most vulnerable to fraud;

- Find out which individuals may expose the organization to fraud risks;

- Examine existing internal controls; and

- Develop plans and techniques to mitigate fraud risks.

Components of Fraud Risk Assessment

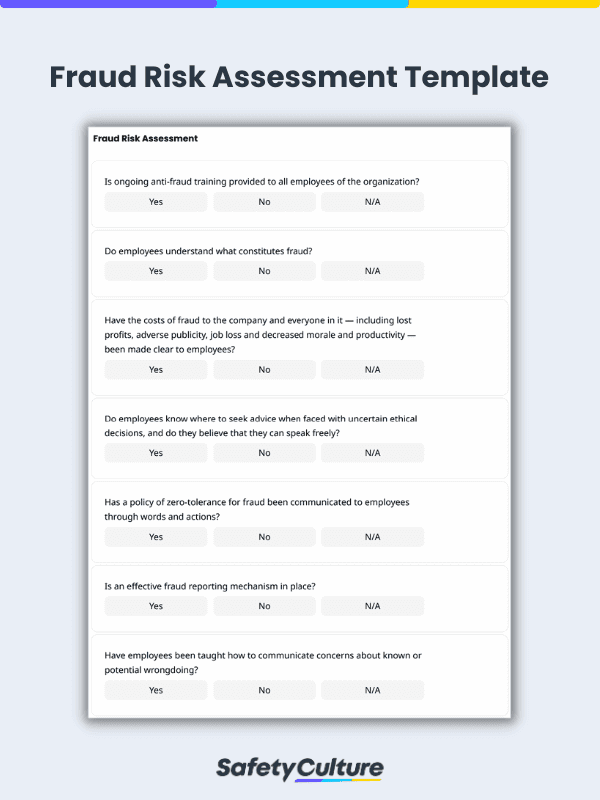

Fraud risk assessments help the organization to identify risks and analyze weaknesses to mitigate business vulnerability to fraud. It is performed using any format that fits the organization for ease of use, understanding, and evaluation. The following components of fraud risk assessment would help risk managers to point out improvement needs.

- Description of fraud risk;

- Existing anti-fraud controls;

- Likelihood of fraud occurrence and significance to the organization;

- Assessment of effectiveness of controls:

- Corrective actions to be implemented; and

- Monitoring activities.

What is a Fraud Risk?

A fraud risk, also often associated with fraud risk factors, is any source of potential fraudulent activity in the business. For example, if an organization heavily depends on a few key people who rarely practice the principle of checks and balances, then the risk of ongoing fraud like false invoicing can be high. Here are some examples of common fraud risk factors based on the fraud triangle:

- Opportunity: inadequate internal controls, poor security measures, and lax senior management

- Pressure, Incentive, or Motivation: personal problems, financial gain, and mental instability

- Rationalization: justification of criminal acts such as “I’ll pay it back.” and “I won’t get caught.”

What are the Types of Fraud Risk?

These are the three basic types of fraud that businesses risk suffering from in any industry:

Asset Misappropriation

The least costly but found to be the most common type of fraud, asset misappropriation makes up 90% of all fraud cases. Some examples of asset misappropriation include:

- the use of company assets for nonwork-related activities

- untrue reimbursement claims

- payroll schemes

- tampering of checks

- stealing cash before it is accounted for

Corruption

Corruption is a type of fraud that involves an employee using their power for their own benefit, to the detriment of their employer or the organization they are working for. Some examples of corruption are:

- bribery

- kickbacks

- contract manipulation

Financial Statement Fraud

Financial statement fraud is the least common type of fraud but it is the most costly and most damaging compared to the other two. This involves the manipulation or misstating of the company’s financial statements with the aim to benefit certain individuals. Some activities considered as financial statement fraud are the following:

- inflating the value of company earnings and/or assets

- understating liabilities

How to Conduct a Fraud Risk Assessment

Here are some tips for conducting an effective fraud risk assessment:

- Build a team – create a team who will plan and set the goals for conducting the risk assessment

- Identify – know what fraud risks your business may be exposed to

- Assess – what will be the risk’s impact on the business? What needs to be done? What’s the cost of in/action?

- Communicate – disseminate a report of your findings along with the fraud policy to the whole organization and other parties concerned

- Implement – take action to address the fraud and put in place updated controls to mitigate fraud risks

- Monitor – continuously monitor your organization through regular random audits, improve processes to control fraud risks, and communicate your findings

Although fraud is an offense that can be committed by anyone in an organization, it appears that frauds are more likely to be committed by males (69%) and individuals in accounting, operations, sales, executive level, customer service, or purchasing. While more than half of fraud cases are done by first-time offenders, company losses due to fraud tend to increase the longer the fraudster stays with the company.

Here are some behavioral red flags that fraud offenders have been found to exhibit:

- Close association with vendors/customers

- Unwilling to share duties

- Living above one’s means

- Showing a wheeler-dealer attitude

Knowing who likely commits fraud or learning about the fraud red flags is not enough to determine the risk of fraud. It is best to learn more about fraud risk assessment to properly conduct this method of determining fraud risk and coming up with ways to mitigate fraud.

Fraud Risk Analysis is essentially the same as a fraud risk assessment in that their common goal is to detect fraud risk areas in businesses. While a fraud risk assessment focuses mainly on determining the likelihood and significance of potential fraudulent schemes, a fraud risk analysis emphasizes on understanding why these fraud threats exist, what factors contribute to possible fraud, and how they affect the organization.