What is a Commercial Due Diligence Checklist?

A commercial due diligence checklist is a comprehensive and structured tool used during Mergers and Acquisitions (M&A) or investment deals to assess the commercial aspects of a target company. It guides prospective buyers or investors in systematically evaluating the target’s market position, customer base, competition, growth potential, and overall business strategy to ensure an informed decision-making process.

Benefits of Using a Commercial Due Diligence Checklist

Since there’s a myriad of items, aspects, and factors being considered during due diligence, it’s important to streamline its process to ensure nothing’s overlooked or inaccurate. This is where using a commercial due diligence checklist helps potential investors or acquirers to achieve the following benefits:

- Comprehensive Assessment

- Optimized Identification of Risks and Opportunities

- Better Negotiations

- Targeted Risk Mitigation

- Enhanced Post-Deal Integration

- Informed Decision-Making

- Confidence and Transparency

- Validation of Assumptions

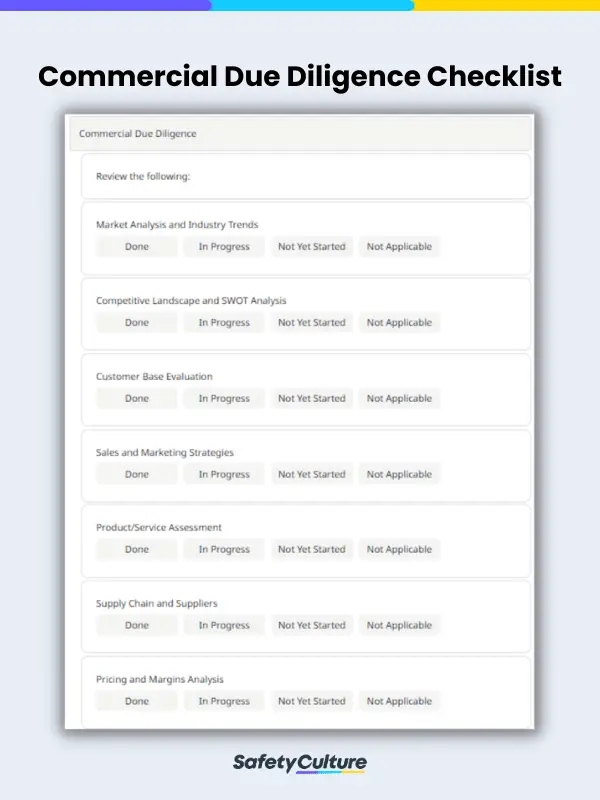

What Should Be Included in a Commercial Due Diligence Checklist?

A comprehensive commercial due diligence checklist must encompass various essential elements and sections to ensure a thorough evaluation of a company’s commercial aspects. The checklist should include sections, such as:

- Market Analysis and Industry Trends

- Competitive Landscape and Strengths, Weaknesses, Opportunities, and Threats (SWOT) Analysis

- Customer Base Evaluation

- Sales and Marketing Strategies

- Product/Service Assessment

- Supply Chain and Suppliers

- Pricing and Margins Analysis

- Distribution Channels

- Regulatory and Legal Considerations

- Intellectual Property Examination

- Financial Performance and Projections

- Management and Key Personnel

- Customer Contracts and Agreements

- Operational Efficiency

- Compliance and Ethical Practices

- Business Strategy and Future Outlook

- Integration and Synergy Opportunities

Each of these plays a crucial role in providing a holistic understanding of the target company’s operations, strengths, weaknesses, and potential risks. By evaluating and addressing these areas, the checklist assists investors or acquirers in making well-informed decisions, identifying potential synergies, and mitigating potential challenges that may arise post-acquisition or investment.

Step-by-Step Guide on Creating a Checklist for Commercial Due Diligence

Follow these steps to create an effective commercial due diligence checklist and ensure an organized evaluation of your target company’s commercial aspects

- Define the objective and scope of the due diligence being performed.

- Gather relevant documents and information about the target company.

- Determine the key components you want to include in the commercial due diligence checklist.

- Conduct initial research on your target company and its industry to gain insights into its market position and competitive landscape.

- Define specific questions tailored to the target company’s unique characteristics and the objectives of the commercial due diligence.

- Involve subject matter experts and stakeholders to review the checklist and provide valuable insights before its implementation.

How to Use One

To help you leverage the many benefits of using a commercial due diligence checklist effectively, here are a few tips and reminders you should consider:

- Collect all relevant documents and information about the target company.

- Perform interviews, data analysis, and research to answer the questions outlined in the checklist.

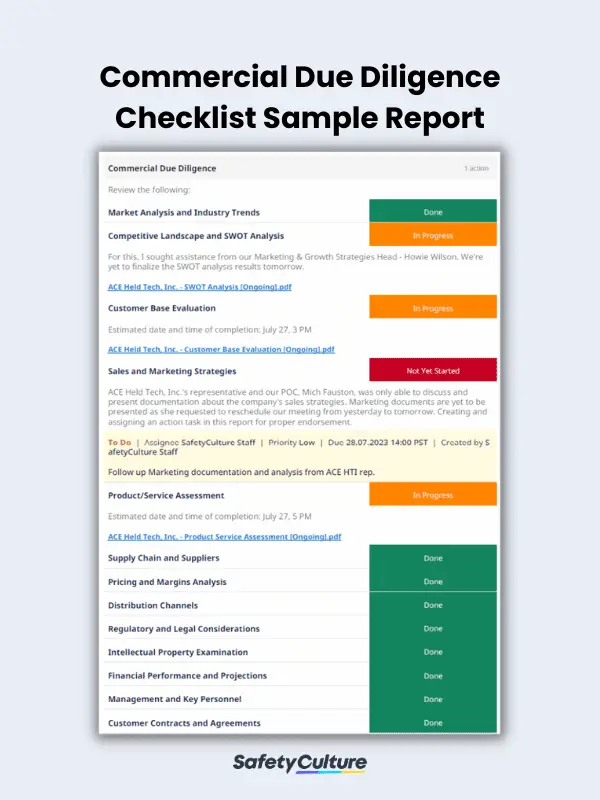

- Record any significant risks, opportunities, key insights, and other observations obtained during the due diligence process.

- Analyze the data and insights obtained to identify patterns, trends, and potential areas for improvement or risk mitigation.

- Utilize the commercial due diligence findings to make informed investment or acquisition decisions.

- Compile the commercial due diligence findings into a comprehensive report for presentation to stakeholders or decision-makers.

- Use the insights gained to plan post-deal integration strategies.

- Gather feedback from stakeholders and subject matter experts to improve the effectiveness of the commercial due diligence checklist. Remember to update it regularly to reflect changes in the target company’s operations or industry trends.

FAQs About Commercial Due Diligence Checklists

Yes, a commercial due diligence checklist can and must be customized for different industries. Each industry has its unique characteristics, market dynamics, and regulatory requirements. Hence, a one-size-fits-all approach may not be as effective in thoroughly evaluating the commercial aspects of a target company in various sectors.

While commercial due diligence checklists are commonly used during M&As or investment deals to evaluate target companies, they can also serve as valuable tools for assessing the commercial aspects of the company’s own operations. This way, they can prepare for future investment opportunities or check their market standing.

If risks or issues were identified with the help of a commercial due diligence checklist, it triggers a series of important actions and considerations for potential investors or acquirers. Here are some sample scenarios:

- Risk Assessment and Mitigation Planning

- Decision-Making and Deal Reevaluation

- Negotiation and Deal Structure Adjustments

- Additional Due Diligence and Expert Opinions

- Post-Deal Integration Planning

- Red Flags or Deal Termination

- Risk Allocation and Mitigation Strategies

- Continued Monitoring and Review