What is an Asset Register Template?

An asset register template is a tool that provides a structured format for recording asset details to monitor, track, and manage an organization’s assets effectively. This template serves as a foundation for asset-related decision-making and planning. It’s a useful tool for asset management, financial reporting, insurance purposes, and compliance with regulatory requirements.

Why Use a Template for Registering Assets

Assets are items or resources that have value and are owned or used by a certain entity, like a company, organization, or individual.

An asset register is used to record important information about these assets, such as their description, acquisition date, cost, depreciation, location, and current status. Moreover, it serves as a central repository of asset information, allowing for easy reference and retrieval of asset-related data.

Using a template for asset registers can be beneficial for organizations in the following areas:

- Efficiency – provides a structured and organized format for recording asset information, consistent and standardized data entry, and easier ways to manage and locate asset details when needed

- Accuracy and Consistency – helps ensure that important details about assets are accurately recorded and consistently maintained to prevent errors, discrepancies, and inconsistencies in asset data

- Compliance and Reporting – lets organizations meet compliance requirements by facilitating the generation of reports or documentation needed for audits, financial statements, and other reporting purposes

- Asset Management – allows organizations to track key information, such as depreciation, maintenance schedules, and disposal or replacement dates

Types of Asset Register Templates

In an organization, assets can mean anything from the tangible items it owns to information it processes and stores for business purposes. To effectively manage such, there must be unique templates dedicated to different types of asset registers, including the following:

- Fixed asset

- Digital asset

- IT asset

- Facility asset

- Information asset

- Hardware asset

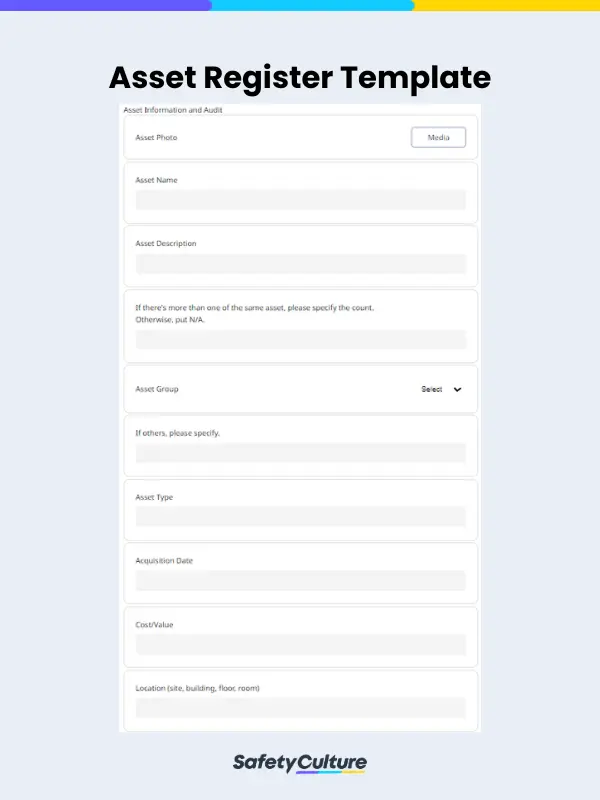

What to Include in an Asset Register Template

Here are some common elements that can be included in an asset register template:

- Asset Description

- Acquisition Date

- Cost

- Depreciation

- Location

- Status

- Responsible Party

- Serial/Asset Number

- Warranty/Insurance Information

- Notes/Comments

Note that these are just some of the common fields that can be included. The template can be customized based on the organization’s specific needs and requirements. Moreover, additional fields can be supplied or existing fields modified to suit the organization’s asset management processes and practices.

How to Create and Use This Template Effectively

To help you maximize the use of an asset register template, follow these steps as you create and fill it out:

- Determine the purpose of the asset register template and the scope of assets that will be included. Consider the types of assets to be recorded, the level of detail required, and the specific information that needs to be captured.

- Enter relevant information for each asset into the appropriate fields.

- Double-check the data entered into the template for accuracy and consistency. Verify that all information is correctly recorded, including dates, numbers, and other details. This step is crucial to ensure the integrity of the asset register data.

- If the template includes fields for depreciation, regularly update the depreciation information based on the organization’s depreciation policy or methodology.

- Utilize the data in the asset register template to generate reports and analyze the assets. This can include financial reporting, asset utilization analysis, maintenance schedules, and other performance metrics.

- Keep all relevant documentation related to the assets, such as purchase invoices, warranties, maintenance records, and disposal certificates, and link them to the respective assets in the asset register template.

- Regularly update the asset register data and template as changes occur to the assets, such as new acquisitions, disposals, transfers, or changes in status.

- Conduct physical audits of assets to verify their existence and condition, and compare the data in the filled-out template with actual assets to identify any discrepancies or errors.

- Provide training and guidance to relevant personnel on using the template effectively and consistently.

FAQs About Asset Register Templates

The responsibility for preparing and maintaining an asset register may fall under different roles within an organization, depending on its size and structure:

- Finance or Accounting Department – records and updates information on assets such as buildings, land, vehicles, equipment, furniture, and other tangible assets, as well as intangible assets such as patents, trademarks, copyrights, and software

- Asset Management Department – oversees the acquisition, utilization, maintenance, and disposal of assets

- Facilities or Property Management Department – prepares and maintains an asset register that includes buildings, land, and related assets

- IT or Technology Department – maintains an asset register specifically for technology assets, such as hardware, software, and other IT infrastructure

It is recommended to update the asset register template regularly to keep it accurate and up-to-date. This may involve updating the template as often as new acquisitions, disposals, transfers, or changes in asset status come in. It’s important to maintain a consistent and timely process for updating the asset register template to ensure that the asset information remains reliable for reporting and decision-making purposes.

It’s essential to maintain other relevant documentation and records related to the assets. This may include purchase invoices, warranties, maintenance records, disposal certificates, and other supporting documents. Linking these documents to the respective assets in the asset register template can help maintain a complete record of the assets and support audits or compliance requirements.