What is a Job Cost Sheet?

A job cost sheet is a document that provides a detailed breakdown of the costs (materials, equipment, labor, and others) involved in producing a particular product or completing a specific job to estimate profitability and ensure it’s within budget. It’s used primarily in manufacturing and construction but can also be used in other industries that involve project-based work.

A job cost sheet is often used together with other financial documents, such as income statements and balance sheets, to provide a complete picture of the business’s financial health. Hence, it’s an essential tool for managing costs and monitoring job progress.

Importance of Using It

In determining the total cost of a job or project, having a job cost sheet that details every expense needed or made allows businesses to compare them to the generated revenue. This tool lets them understand the profitability of a job and make informed decisions about pricing, resource allocation, and future projects.

Also, it’s a key tool used to track the progress of a project to identify aspects where costs can be reduced and eliminated or efficiencies can be optimized. Knowing these can help improve processes, enhance profitability, and increase overall efficiency.

Moreover, using a job cost sheet when managing expenses in projects is crucial for various reasons, including the following:

- Accurate cost estimation

- Cost control

- Job progress

- Improved decision-making

- Compliance

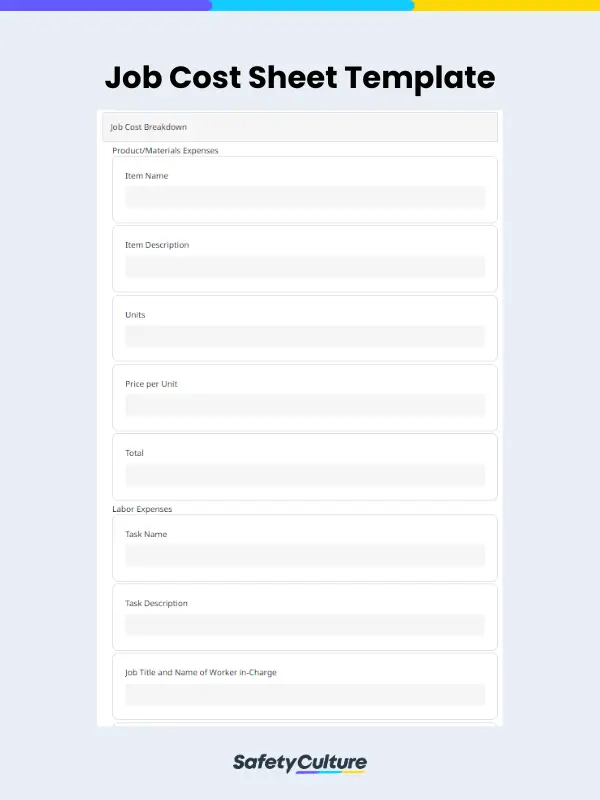

What to Include in One

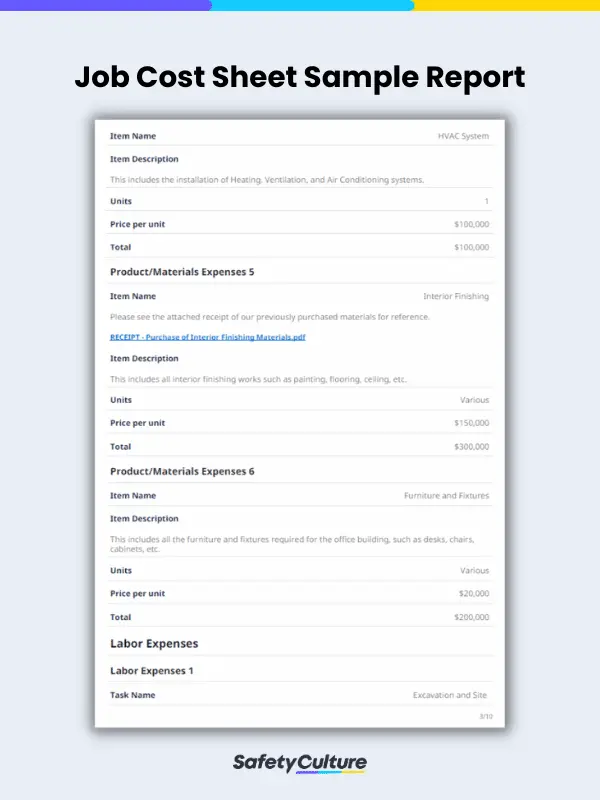

To ensure every information needed in documenting and tracking project expenses is completed and accounted for, a job cost sheet should include the following elements using a template:

- Job Information: The name or description of the job, the date it was started, and its expected completion date.

- Labor Costs: A breakdown of the labor costs associated with the job, including the number of hours worked and the rate of pay for each worker.

- Material Costs: A detailed list of the materials used for the job, including the quantity, unit price, and total cost.

- Equipment Usage: If any equipment was used for the job, it should be listed along with the cost of rental or depreciation.

- Subcontractor Costs: If any work was subcontracted out, the cost of the subcontractor’s services should be included.

- Overhead Costs: Indirect costs associated with the job, such as utilities, rent, and insurance.

- Other Expenses: Any other expenses associated with the job, such as travel or meals, should be included.

- Total Job Cost: The total cost of the job should be calculated and listed at the bottom of the job cost sheet.

How to Prepare a Job Cost Sheet and Use It in Your Projects

To guide you in creating a template for your job cost sheets, here are some tips and steps you can take:

- Identify the specific job or project for which you want to create the job cost sheet. This could be a construction project, manufacturing run, or any other type of project-based work.

- Make a list of all the cost elements associated with the job. This will typically include labor costs, material costs, equipment usage, subcontractor costs, overhead costs, and any other expenses related to the job.

- Collect all relevant data for each cost element. This may involve consulting with team members, reviewing invoices and receipts, and tracking time spent on the job.

- Organize the data into a format that can be easily analyzed and tracked. A checklist or template can be useful for this purpose.

- Add up all the costs associated with the job to calculate the total expenses. This will provide an estimate of the profitability of the job and allow for cost-control measures to be put in place.

FAQs About Job Cost Sheets

A job sheet, also known as a work order or job card, is a document used to track the progress of a specific job or task. Usually, it includes the name of the project manager, the date the job was assigned, the expected completion date of the project, and any job specifics or requirements. However, a job cost sheet is a document used to record and track the costs associated with a specific job or project.

Project managers and other personnel responsible for expense tracking must use a job cost sheet to record the following costs and more depending on the project:

- Labor costs, including the wages and salaries of all workers involved in the project

- Material costs, including raw materials, supplies, and others needed to complete the job

- Equipment usage costs, such as machinery, vehicles, or tools

- Subcontractor costs of electricians or plumbers

- Overhead costs, such as rent, utilities, and administrative expenses

Job cost sheets are usually prepared by the project manager or a designated member of the project team responsible for cost tracking and management. In some cases, an accountant or financial analyst may also be involved in the preparation of job cost sheets to ensure accuracy and compliance with accounting standards.